The morning began with a cycling session, setting a positive tone for the day. The physical exertion invigorated & providing clarity and focus for the tasks ahead.

Working from home presented unique challenges and opportunities. While the flexibility was advantageous, managing concentrations and maintaining motivation without the usual office distractions required deliberate effort. Despite these hurdles, the ability to address tasks efficiently allowed for effective progress on various projects.

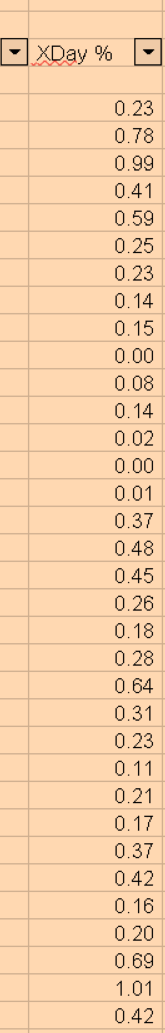

Engaging in cryptocurrency swaps between $HIVE and $HBD was a strategic move.

The dynamic market conditions required constant vigilance, as each swap was guided by the latest trends and analyses.

While profitable, these transactions also carried inherent risks, necessitating careful consideration of each move to optimize outcomes.

The revenue goal remains a focal point despite the challenging journey toward achieving the daily average.

Despite obstacles and fluctuating market conditions, maintaining a positive outlook was crucial for staying motivated.

The resilience demonstrated so far suggests continued determination to exceed yearly targets.

The favorable price movement between $HIVE and $LTE signified a turning point in recent investments. Past trades executed late last year have shown significant profitability, driven by the upward trajectory of these assets.

This success provides a solid foundation for future buying strategies, particularly below the 390 mark, where substantial opportunities still exist.

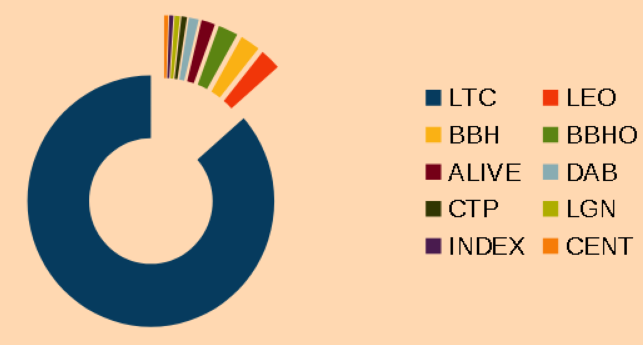

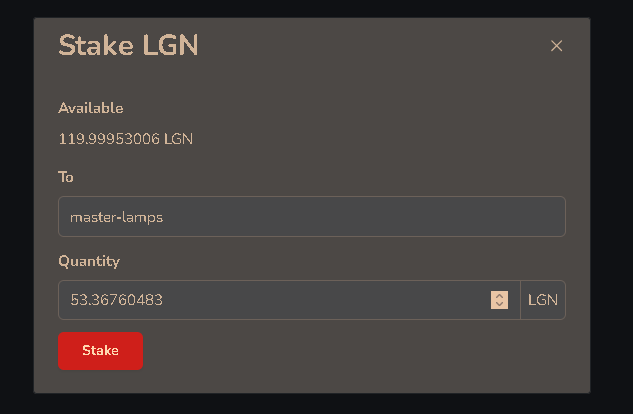

Currently holding a stake in LGN at position 67, which is considered ticklish, indicates potential volatility. The decision to increase this position involves careful consideration of market trends and risk management.

Additionally, leveraging past revenue from last year's investments has provided the means to diversify holdings further, aiming for higher returns through strategic moves.

Investing in $LEO utilizing last year's revenue demonstrates confidence in its growth potential. By allocating a significant portion of these funds into LEO, the aim is to achieve substantial returns, potentially doubling investments. This approach reflects a calculated risk strategy based on thorough analysis and market insights.

Anticipation builds as the user awaits future distributions from $BBH and $BHHO. The continuous growth of the $BBH bag suggests a promising passive income stream. Considering a shift towards more predictable revenue sources, especially with ongoing investments, indicates a strategic pivot toward financial stability while maintaining growth opportunities.