If you like trading with crypto on spot markets or on perpetuals, you might want to check out hyperliquid. Hyperliquid is not exactly something new or totally innovative. It's an existing service but taken to another level. Let me explain...

The problems with trading

When you want to trade crypto perpetuals, you have several options. You can do it on centralised platforms like binance for example with the risk of having your money in a place where you don't own the keys. There are also decentralised perpetual exchanges like drift on Solana or navigator on Sonic which do the trading directly on chain.

The big problem with most of these perpetual exchanges is that you have plenty of fees that reduce your income potential. You have not only trading fees, funding fees, transaction fees but also slippage fees because of the fact that the trading takes place in the context of liquidity pools. This makes trading with perpetuals quite expensive and often not profitable if you trade with smaller amounts.

The solution provided by hyperliquid – a decentralised order book

Contrary to most other perpetual markets, hyperliquid offers a market based on an order book. Its the same technology that is used by the share markets for example. The advantage of an order book is that there is no slippage. There are also issues related to limit orders like stop losses that this resolves. In liquidity pools, limit orders can be executed quite far from the limit that has been set because the liquidity pool moves fast if the amount of tokens exchanged is big.

Contrary to most decentralized exchanges, Hyperliquid is based on a transparent order book that is inserted in the blockchain

No gas fees

The second solution that hyperliquid is providing is the absence of transaction fees. The whole market works on a very fast blockchain and all orders are on the blockchain but there are no gaz fees when it comes to trading on it. This is definitely a major advantage for Hyperliquid.

Very small fees

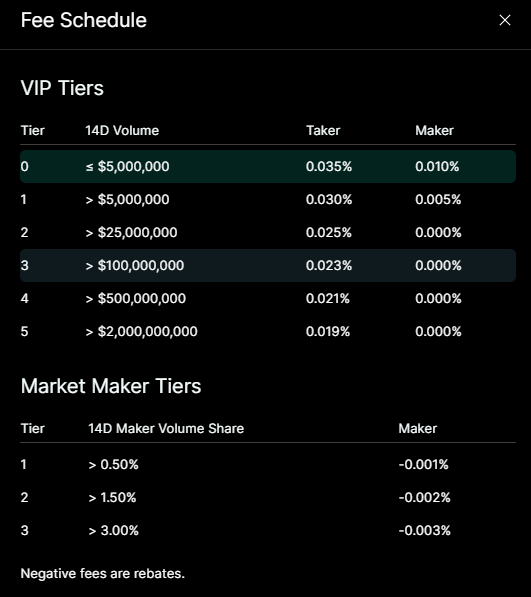

When you set up orders on hyperliquid you have very low fees that range from 0.01 to 0.035% of your transaction. For comparison, this starts at 0.075% on Binance. On both platforms, you can have lower fees with more investment and more transactions but for newbies, Binance is more expensive. There are also funding fees that are quite dynamic on both platforms.

Fee structure on Hyperliquid

Why is it important to have low fees

When you trade, you need an edge to make a profit and fees typically work against that. The higher the fees, the more edge you need. Therefore, hyperliquid offers an outstanding offer for traders.

How to get started on hyperliquid

To get started on hyperliquid, you need to deposit USDC over arbitrum to your account. You can use any bridge to send USDC and some ETH for transacting. Once your money is deposited, you can start trading with up to 50x leverage.

I deposited 40 USDC and managed to trade with a volume of 10'000 $ within a week!

My take on hyperliquid

I really like the very intuitive platform and the order book concept. Things are very transparent and it's easy to do some trades. When you set limit orders instead of market orders, your fees are almost insignificant which makes it possible to bet on volatility for example. You can buy a coin for 100.00 and sell for 100.02 and make a profit.

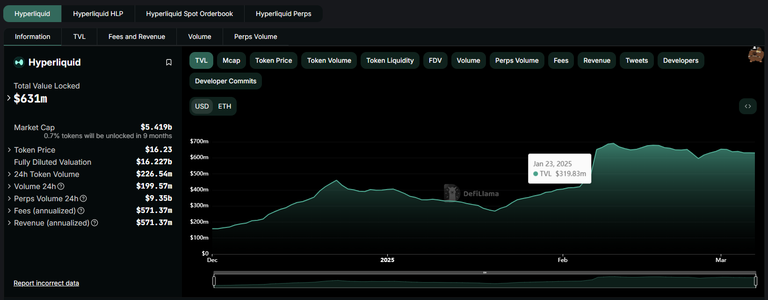

I'm not a big fan of trading mainly because I hate the fees and the stress. On hyperliquid, I started to enjoy myself trying out different strategies and doing a lot of transactions. I understand why hyperliquid has managed to attract over 600 million dollars in TVL...

Source: https://defillama.com/protocol/hyperliquid?denomination=USD

Save some more fees when registering

When you trade with a volume above 10'000 $, you can set up a referral code. If people sign up with the referral code, they get a 4% discount on the fees and the referrer gets rewards as well. You can use my referral link to sign up and we will both profit from it: https://app.hyperliquid.xyz/join/ACHIM03

Before starting to trade make sure that you know the risks

Trading with leverage is always a very big risk and I suggest that you understand what you are doing before starting. This is by no way financial advice and I encourage you to do your research before starting. I needed to understand things myself and I made some costly mistakes. I started with only 40$ that I consider as an investment in learning how the platform works. Maybe you can do the same...

With @ph1102, I'm running the @liotes project.

Please consider supporting our Witness nodes: